Enterprise Risk Management

Identify and Assess Existing & Emerging Enterprise Risks

Enterprise Risk Management

ERM is a comprehensive and systematic approach used by organizations to identify, assess, prioritize, and manage risks that could impact their objectives and goals. ERM aims to minimize the potential negative consequences of risks while also taking advantage of potential upside opportunities that may arise from them.

When properly implemented, ERM is often integrated into an organization's overall strategic planning and decision-making processes. Today, there are many well-known ERM frameworks in common use. Some like Basel III and Solvency II are mandatory for some banks and insurers, while others like COSO and ISO 31000:2018 are merely advisory frameworks that may be adopted by any organization.

The Case for ERM

Organizations operate in a constantly changing environment with a myriad of disruptive forces and events that can severely impact their ongoing operation and ultimate survival. Nevertheless, organizations are expected to take proactive actions to identify these potential risks and to implement appropriate measures to address them.

A well implemented ERM framework would allow the organization to identify existing and emerging risks and would ensure that effective contingent plans, risk mitigation, or other risk management actions are in place. Implementing an effective Enterprise Risk Management (ERM) framework would provide the necessary assurances to the shareholders, regulators, board, senior executives, and other interested stakeholders that the company is being managed in a more prudent and responsible manner.

Enterprise Risk Management (ERM) is the practical application of a guiding framework and disciplined processes by an entity to identify, assess, control, exploit and monitor Risks and Opportunities from all sources in order to achieve the entity’s strategic and financial objectives.

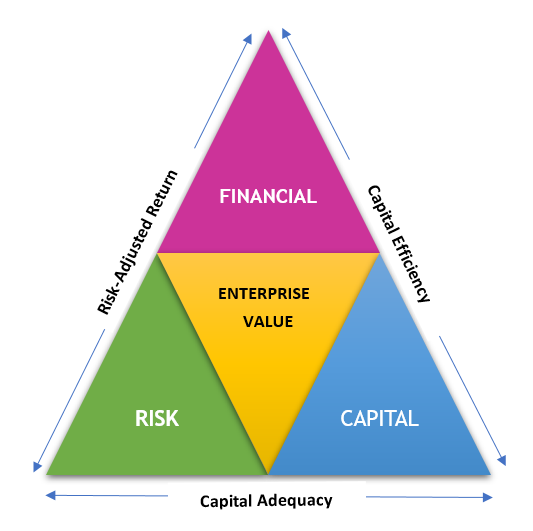

Optimizing the Integration of Risk, Capital, and Financial Management is key to enhancing Corporate Value.

Typical Measures

- RISK – Economic Capital

- CAPITAL – Available Capital

- FINANCIAL – Risk Adjusted Return on Capital

Our Solution

At GFRAM Consulting we will guide our clients in navigating, disrupting, and exploiting potential risks in order to minimize their threat impact and in some instances to turn those risks into opportunities. Our ERM approach can be tailored to the nature, scale, complexity, and priority of your business. Further, the framework and processes embedded in our approach will allow your organization to create improved Enterprise Value by optimizing the linkages between the following three critical areas of Management:

Our specific ERM capabilities include, but are not restricted to, the following:

Why GFRAM

GFRAM Consulting is superbly qualified to solve your ERM needs given our extensive practical experience in developing, implementing, and managing real life ERM frameworks for major organizations globally. Further, our ERM Consultants have acquired the most prestigious and rigorous Risk Management credentials including CERA, FRM, FSA, and PhD. Our investment in formal training and our practical real-world experiences speak to our technical know-how and readiness to provide practical risk management solutions for the full breadth of risks facing your organization.

Risk Categories

Risk practitioners and most organizations tend to categorize their risks using a somewhat consistent approach e.g. market risk, credit risk, operational risk. However, less consistent and broader categories are sometimes used for risk aggregation, management focus, or other specific purposes. One such succinct categorization is depicted below: